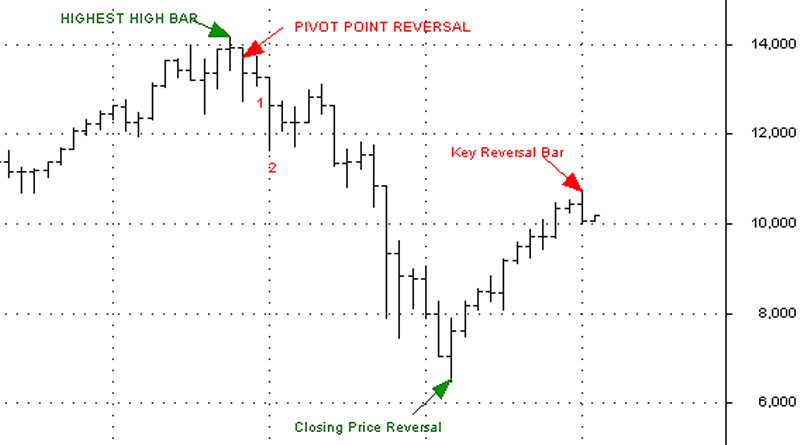

Bar Reversal Patterns:

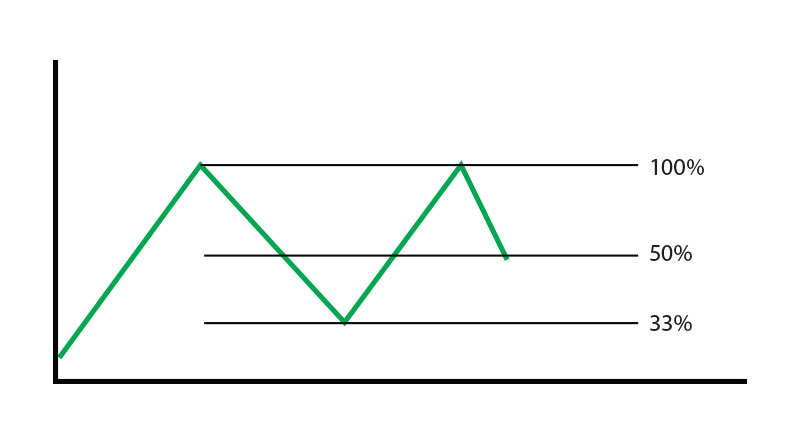

When a particular bar or a group of bars combined together speaks for a change in the trend a bar reversal has occurred. In this article different types of bar reversal patterns are described.

Table of Contents When a particular bar or a group of bars combined together speaks for a change in the trend a bar reversal has occurred. If is a reversal phenomenon hence, it will occur only after a prolong rise or a prolong fall. Bar reversals are of four types. Key Reversal Perfect upward bar …

When a particular bar or a group of bars combined together speaks for a change in the trend a bar reversal has occurred. In this article different types of bar reversal patterns are described.

Read More »