Retracement means the correction of the previous movement. According to the theory there are many retracement levels. Out of these, the most important are the following.

- 33% or 1/3rd of the previous movement happens to be a crucial support or resistance level as the case may be. If the previous trend is strong enough, no retracement normally extends beyond 33%.

- If it is ever found that 33% level gets violated, the next level to watch for is 50% level. This 50% level retracement is popularly known as halfway retracement level, 50% retracement level in reality works like a magic. It is generally not possible for the price to break this 50% level so easily.

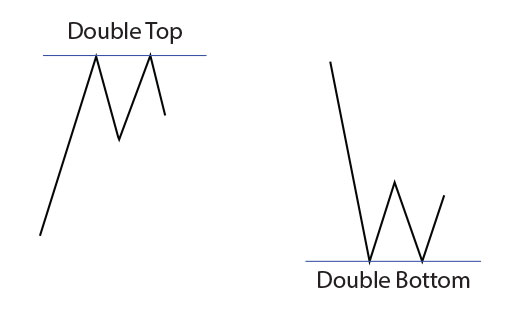

- If 50% level ever gets violated for any of the other reason the next level to watch is 66% as per the theory, but practical observation over the years has taught us that although 66% level has been theoretically defined but any retracement below 50% normally takes the price back to the level from where it started rising, so this is 100% retracement. In the technical, the time this 100% retracement in the down side is known as double bottom. A double bottom is a very strong place of support. Price flairs up from the double bottom level and gradually in future goes back to the previous top from where it started falling. This is called a double top formation. A double top is a very strong supply point. In future when the price again gets back to the double bottom level for the 3rd time, we can call it a triple bottom. Like double bottom, triple bottom is another strong place of support, in future when the price again goes up to the top level for the 3rd attack, it is called a triple top, which is another selling point. According to the suggestion of world master, buy at single bottom, buy at double bottom or triple bottom, sell at the single top, sell at the double top and triple top. Never buy at the 4th bottom and never sell at 4th top. The historical research data has proved that the 4th time the price attack on either side, normally it gets through. The importance of the double bottom and triple bottom, and double top and triple top depend on the time gap between the bottom and the tops. In fact, longer the time distance between the two successive tops and bottoms, stronger it will be. Another important factor to watch on the tops and bottoms is volume. Volume plays a very crucial role in determining the strength of such tops and bottoms.

Click to rate this post!

[Total: 0 Average: 0]